Reuters

Sep 9, 2009

Richemont 5-month sales slip 16%, cautious outlook

Reuters

Sep 9, 2009

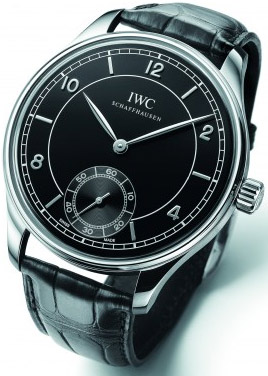

IWC watch |

ZURICH, Sept 9 (Reuters) - Richemont (CFR.VX), the luxury goods group behind Cartier jewellery and Chloe handbags, struck a cautious note about future demand on Wednesday 9 September amid signs the rate of decline in its sales was slowing.

"We would prefer to wait until we have more evidence of a broader economic recovery before speculating on the likelihood of a better second half, particularly when it comes to the wholesale business," Chairman Johann Rupert, whose family controls the group, said in a statement.

Demand between April and August for Richemont's goods, which include watches from prestigious brands like IWC and Jaeger-LeCoultre, Montblanc pens and Lancel accessories, slipped 16 percent at actual exchange rates and 21 percent in constant exchange rates.

Analysts had expected sales to fall 15 percent and 21 percent, respectively, according to a Reuters poll.

Richemont, which is the world's second largest luxury goods group behind LVMH (LVMH.PA), said profitability would be lower in the first six months of the year than in the six months to September last year despite cost-control measures.

Cartier, Richemont's biggest brand, said earlier this month the worst of the crisis was probably behind it as strong demand in China and the Middle East offsets weakness in Japan and the United States.

(Reporting by Katie Reid; Editing by Hans Peters, John Stonestreet)

© Thomson Reuters 2024 All rights reserved.